USA A Insurance 2024: Navigating Financial Security in an Uncertain World

In an unpredictable world, insurance serves as a cornerstone of financial stability. The United States is home to a dynamic and extensive insurance industry that covers a wide range of sectors, offering essential protection for both individuals and businesses. Join us as we explore the complexities of insurance in the USA, examining the different types of coverage, major industry players, and essential factors to consider when securing comprehensive protection.

COMPANY DETAILS

| Company Name | USA A INSURANCE |

| Job Location | USA |

| Nationality | All Nationality Can Apply |

| Education | Diploma/Degree in Relevant Position |

| Experience | Preferred |

| Salary Range | Depending Upon the Job Title |

| Employee Benefits | Attractive |

Types of Insurance in the USA

Health Insurance

One of the cornerstones of the American insurance landscape is health insurance. In a nation where healthcare costs can be exorbitant, having a comprehensive health insurance policy is essential for individuals and families.

Auto Insurance

Owning a vehicle in the USA comes with the responsibility of securing auto insurance. We’ll unravel the complexities of auto insurance, from coverage options to factors influencing premiums.

Homeowners Insurance

For those with a place to call home, homeowners insurance is a must. We’ll break down the components of a homeowners policy and explore why it’s crucial for protecting your most significant investment.

Life Insurance

Looking beyond the present, life insurance provides a safety net for loved ones in the event of an untimely demise. We’ll discuss the types of life insurance and how to choose the right policy for individual needs.

Business Insurance

Businesses, both small and large, rely on insurance to mitigate risks. We’ll navigate through the intricacies of business insurance, examining coverage options and industry trends.

Key Players in the US Insurance Market

Leading Insurance Companies

In a competitive market, certain companies stand out for their reliability and customer satisfaction. We’ll highlight the key players shaping the insurance landscape in the USA.

Market Trends and Innovations

The insurance industry is not immune to technological advancements and evolving customer expectations. We’ll explore current trends and innovations influencing the way insurance is bought and sold.

Understanding Insurance Policies

Policy Components

Insurance policies can be dense with legal jargon. We’ll simplify the language, explaining the key components of an insurance policy and what policyholders need to pay attention to.

Coverage Options

Different types of insurance offer various coverage options. We’ll provide insights into tailoring coverage to meet specific needs, ensuring policyholders aren’t underinsured or paying for unnecessary coverage.

Factors Affecting Insurance Premiums

Age and Health

Age and health status play a significant role in determining insurance premiums. We’ll discuss how these factors impact the cost of health and life insurance.

Driving Record

For those seeking auto insurance, a clean driving record is a valuable asset. We’ll delve into how driving history influences premiums and coverage eligibility.

Location and Property Value

Homeowners and renters insurance premiums can vary based on location and property value. We’ll examine these geographical factors and their impact on insurance costs.

Navigating the Insurance Buying Process

Researching Options

Before committing to a policy, it’s crucial to research available options. We’ll guide you on where to find reliable information and how to compare different insurance products.

Comparing Quotes

Price is a significant factor in insurance decisions. We’ll explore the importance of obtaining and comparing quotes to ensure affordability without compromising coverage.

Understanding Policy Terms

Insurance policies can be laden with complex terms. We’ll demystify the language, empowering you to understand the terms and conditions of your chosen policies fully.

Importance of Adequate Coverage

Real-Life Examples

Stories of individuals and businesses facing unexpected events without adequate insurance coverage highlight the importance of being prepared. We’ll share real-life examples illustrating the impact of insurance on financial security.

Financial Protection for Families and Businesses

Insurance isn’t just a legal requirement; it’s a financial safeguard. We’ll discuss how having adequate coverage can protect families from financial ruin and businesses from unforeseen liabilities.

Common Myths About Insurance

Debunking Misconceptions

Misconceptions about insurance abound. We’ll debunk common myths, addressing concerns that may deter individuals from obtaining the coverage they need.

The Importance of Fact-Checking

In the age of information, separating fact from fiction is crucial. We’ll emphasize the importance of fact-checking to ensure you make informed decisions about your insurance needs.

Government Regulations and Compliance

State-by-State Variations

Insurance regulations vary from state to state. We’ll provide an overview of these variations and highlight how they impact the purchasing and maintenance of insurance policies.

Consumer Protections

Governments enact regulations to protect consumers. We’ll explore the safeguards in place to ensure fair practices within the insurance industry and how consumers can leverage these protections.

The Role of Insurance Agents

Their Expertise

Insurance agents play a vital role in guiding individuals and businesses through the insurance landscape. We’ll discuss the expertise they bring and how to choose an agent that suits your needs.

How to Choose the Right Agent

Selecting the right insurance agent can be a game-changer. We’ll provide tips on how to evaluate and choose an agent who understands your needs and offers tailored advice.

Impact of Technology on the Insurance Industry

Digital Transformation

Technology is reshaping how insurance is bought and managed. We’ll explore the digital transformation within the industry, from online policy purchases to digital claims processing.

Online Claims and Customer Service

The convenience of online services extends to insurance claims and customer service. We’ll discuss the benefits and potential drawbacks of handling insurance matters online.

Dealing with Insurance Claims

Step-by-Step Process

Filing an insurance claim can be a daunting task. We’ll provide a step-by-step guide, ensuring policyholders navigate the claims process efficiently and effectively.

Common Pitfalls to Avoid

Mistakes in the claims process can lead to delays or denials. We’ll highlight common pitfalls and offer advice on how to avoid them, ensuring a smoother claims experience.

Tips for Saving on Insurance

Bundling Policies

Combining multiple insurance policies can lead to significant savings. We’ll explore the concept of bundling and how it can be a cost-effective strategy for policyholders.

Taking Advantage of Discounts

Insurance companies offer various discounts. We’ll identify common discounts available and provide tips on how to maximize savings while maintaining comprehensive coverage.

Future Trends in the US Insurance Sector

Predictions and Projections

The insurance industry is dynamic, with trends that shape its future. We’ll delve into predictions and projections, offering insights into what the future holds for insurance in the USA.

Evolving Customer Needs

As consumer needs evolve, so does the insurance landscape. We’ll explore how the industry adapts to changing customer expectations and emerging trends.

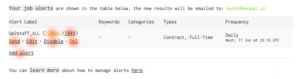

APPLYING LINK

| JOB TITLE | LOCATION | ACTION |

|---|---|---|

| USA A INSURANCE | USA | View &Apply |

Conclusion

In conclusion, insurance is not just a financial product; it’s a shield against the uncertainties of life. Making informed choices about insurance is paramount for individuals and businesses alike. By understanding the types of insurance, navigating the buying process, and staying informed about industry trends, you can secure a brighter and more secure future.

FAQs

Is insurance mandatory in the USA?

While certain types of insurance, like auto insurance, may be mandatory, others are optional but highly recommended for financial security.

How often should I review my insurance policies?

It’s advisable to review your insurance policies annually or whenever a significant life event occurs, such as buying a home or having a child.

What factors can impact my insurance premiums?

Factors such as age, health, driving record, and location can influence insurance premiums.

Can I switch insurance providers easily?

Yes, switching insurance providers is possible. However, it’s essential to research and compare options before making the switch.

Are online insurance purchases safe?

Yes, many reputable insurance providers offer secure online platforms for purchasing policies. Ensure the website is legitimate before providing personal information.